Renters Insurance in and around Garland

Welcome, home & apartment renters of Garland!

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

Calling All Garland Renters!

It's not just the structure that makes the home, it's also what's inside. So, even if your home is a rented property or house, renters insurance can be a good idea to protect your belongings, including your desk, laptop, lamps, clothing, and more.

Welcome, home & apartment renters of Garland!

Coverage for what's yours, in your rented home

State Farm Has Options For Your Renters Insurance Needs

When renting makes the most sense for you, State Farm can help protect what you do own. State Farm agent Thinh Nguyen can help you with a plan for when the unpredictable, like an accident or a water leak, affects your personal belongings.

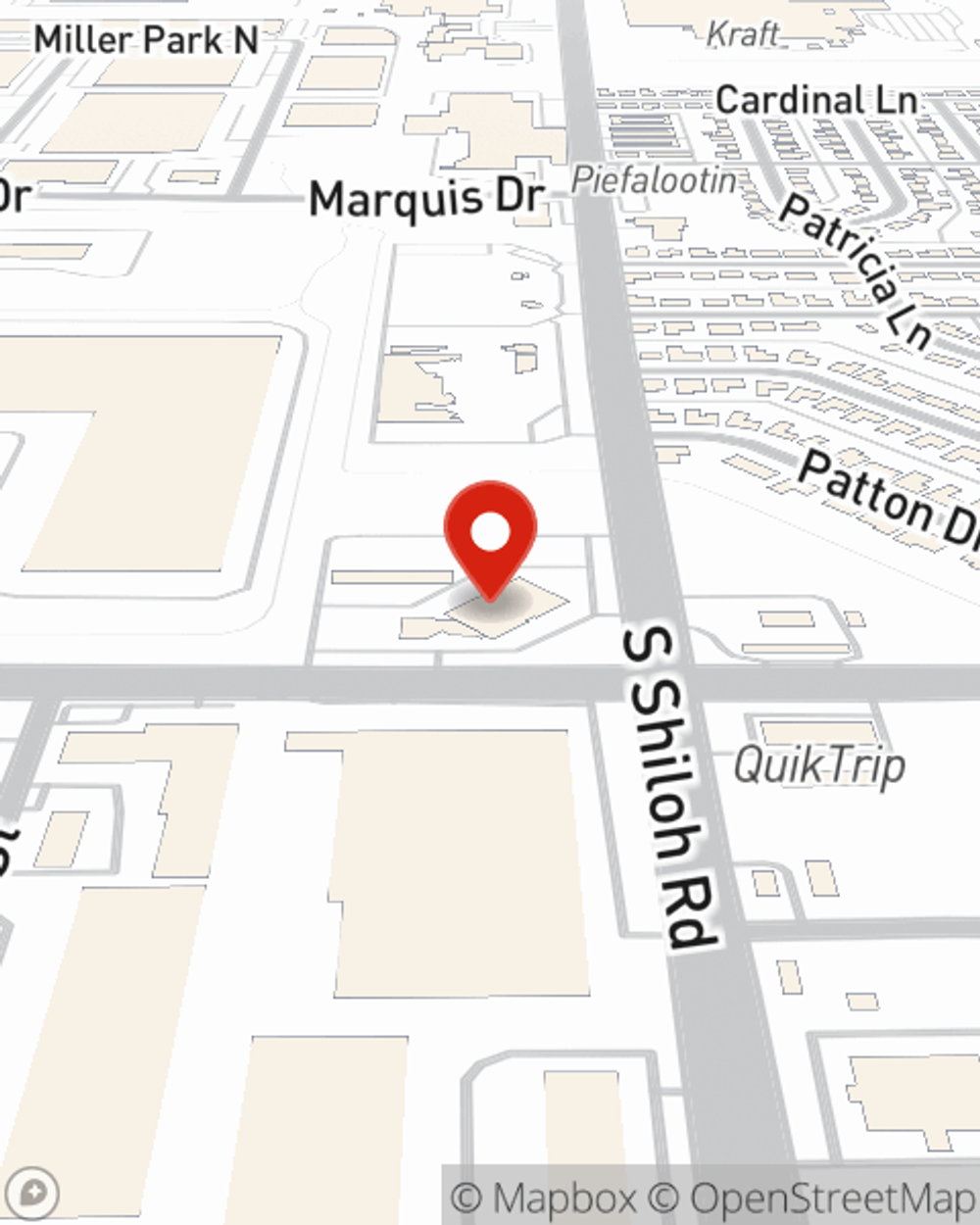

There's no better time than the present! Visit Thinh Nguyen's office today to see how helpful renters insurance can be.

Have More Questions About Renters Insurance?

Call Thinh at (469) 326-3335 or visit our FAQ page.

Simple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Does renters insurance cover hotel stay?

Does renters insurance cover hotel stay?

Renters insurance may offer support for hotel stays and temporary housing costs when your rented home becomes unhabitable due to a covered claim.

Thinh Nguyen

State Farm® Insurance AgentSimple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Does renters insurance cover hotel stay?

Does renters insurance cover hotel stay?

Renters insurance may offer support for hotel stays and temporary housing costs when your rented home becomes unhabitable due to a covered claim.